The Power of Trading Breakouts and Consolidations: a Comprehensive Guide:

Are you ready to take your trading game to the next level? If so, then it’s time to unlock the potential for profit by mastering the art of trading breakouts and consolidations. These two powerful strategies have been proven time and again to deliver impressive returns for experienced traders.

In this article, we will delve into the world of trading breakouts and consolidations, providing you with the knowledge and techniques necessary to make informed trading decisions. We will explore how to identify breakout and consolidation patterns, understand their significance, and effectively capitalize on them to maximize your profits.

Whether you are a seasoned trader looking to enhance your skills or a beginner looking to enter the world of trading, this article is for you. By the end, you will have the tools and strategies needed to navigate these market phenomena and turn them into opportunities for financial gain. So get ready to unleash the power of trading breakouts and consolidations – your potential for profit awaits!

Lock in your success with these proven strategies and start trading like a pro today.

Understanding Breakouts and Consolidations

Before diving into the strategies and techniques, it’s crucial to understand what breakouts and consolidations are in the context of trading. Breakouts occur when the price of an asset breaks through a significant level of support or resistance, leading to a sharp price movement in the direction of the breakout. Consolidations, on the other hand, represent periods of price consolidation within a defined range, often characterized by lower volatility and a lack of clear direction.

Breakouts and consolidations are both natural market phenomena that occur due to various factors, including market sentiment, supply and demand dynamics, and fundamental news events. As traders, our goal is to identify these patterns and capitalize on them to generate profits.

Benefits of Trading Breakouts and Consolidations

Trading breakouts and consolidations offer several benefits that make them attractive strategies for traders. Firstly, breakouts provide an opportunity to catch significant price movements and profit from the momentum created by the breakout. By entering a position early in the breakout, traders can ride the wave and maximize their gains.

On the other hand, consolidations offer a chance to trade within a defined range, taking advantage of smaller price fluctuations. This approach can be particularly useful for traders who prefer a more conservative approach or for those operating in markets with lower volatility.

Another advantage of trading breakouts and consolidations is the potential for high reward-to-risk ratios. By properly identifying and timing these patterns, traders can enter positions with manageable risk and the potential for substantial rewards. This favorable risk-reward profile makes breakouts and consolidations enticing opportunities for traders.

Common Patterns in Breakouts and Consolidations

To effectively trade breakouts and consolidations, it is essential to familiarize yourself with the common patterns that often precede these market phenomena. Some of the popular breakout patterns include the “triangle,” “rectangle,” and “head and shoulders” patterns.

Triangle patterns occur when the price forms a series of lower highs and higher lows, forming a triangular shape on the chart. A breakout from this pattern typically leads to a significant price movement in the direction of the breakout.

Rectangle patterns are characterized by horizontal support and resistance levels, with the price oscillating between these levels. A breakout from this pattern occurs when the price breaks through either the support or resistance level, indicating a shift in market sentiment.

Head and shoulders patterns are recognizable by three peaks, with the middle peak (the head) being higher than the other two (the shoulders). A breakout from this pattern often signals a reversal in the current trend.

Consolidations, on the other hand, can take the form of channels, flags, or pennants. Channels are parallel lines that connect the highs and lows of the price, indicating a period of consolidation. Flags and pennants are short-term consolidation patterns that typically occur after a significant price move.

Strategies for Trading Breakouts

Now that we have a solid understanding of breakouts and the patterns associated with them, let’s explore some strategies for trading breakouts. One popular approach is the “retest and continuation” strategy, where traders wait for the price to break out of a key level and then retest that level before entering a trade.

The rationale behind this strategy is that a retest of the breakout level provides confirmation that the breakout is valid and increases the probability of a successful trade. By waiting for the retest, traders can enter a position with a tighter stop loss and potentially improve their risk-reward ratio.

Another strategy is the “breakout pullback” strategy, which involves waiting for the price to break out of a consolidation pattern and then pull back to a key support or resistance level. This pullback provides an opportunity to enter a trade in the direction of the breakout, with the expectation that the price will continue moving in that direction.

Both of these strategies require patience and discipline, as traders must wait for the right conditions to enter a trade. However, when executed correctly, they can yield impressive results and take advantage of the momentum created by breakouts.

Strategies for Trading Consolidations

While breakouts offer the potential for significant price movements, trading consolidations can also be profitable if approached with the right strategies. One such strategy is the “range trading” approach, where traders buy at support levels and sell at resistance levels within the consolidation range.

The key to successful range trading is identifying reliable support and resistance levels. These levels can be determined using technical analysis tools such as trend lines, moving averages, or Fibonacci retracement levels. By buying near support and selling near resistance, traders can profit from the price oscillations within the consolidation range.

Another strategy for trading consolidations is the “breakout trading” approach. Instead of trading within the range, traders wait for a breakout from the consolidation and enter a position in the direction of the breakout.

To increase the probability of a successful breakout trade, it is crucial to wait for confirmation of the breakout. This confirmation can come in the form of increased volume, a strong candlestick pattern, or a break above a significant resistance level. By waiting for confirmation, traders can filter out false breakouts and focus on high-probability trades.

Risk Management in Trading Breakouts and Consolidations

As with any trading strategy, risk management is a crucial aspect of trading breakouts and consolidations. While these strategies offer the potential for substantial profits, they also come with inherent risks.

One important risk management technique is the use of stop-loss orders. A stop-loss order is an instruction to sell a security at a predetermined price, limiting the potential loss on a trade. By setting a stop-loss order at a level that invalidates the trade setup, traders can protect themselves from significant losses.

Another risk management technique is position sizing. Position sizing refers to determining the appropriate amount of capital to allocate to each trade. By risking only a small percentage of your trading capital on each trade, you can minimize the impact of losing trades and protect your overall portfolio.

Furthermore, it is essential to avoid overtrading and maintain discipline in your trading approach.

Overtrading can lead to emotional decision-making and impulsive trades, which can be detrimental to your trading success. Stick to your trading plan and only take trades that meet your criteria.

Tools and Indicators for Identifying Breakouts and Consolidations

To effectively identify breakouts and consolidations, traders can utilize various tools and indicators. One commonly used tool is trend lines, which help identify the direction of the trend and potential breakout or consolidation levels.

Trend lines are drawn by connecting significant swing highs or lows on a price chart. When the price breaks above or below a trend line, it can signal a potential breakout or the end of a consolidation.

Another useful indicator is the Average True Range (ATR), which measures the volatility of an asset. By analyzing the ATR, traders can gauge whether the price is in a consolidation phase or experiencing a breakout with increased volatility.

Other indicators that can be helpful in identifying breakouts and consolidations include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). These tools can provide additional confirmation and insights into the market conditions.

Case Studies of Successful Breakout and Consolidation Trades

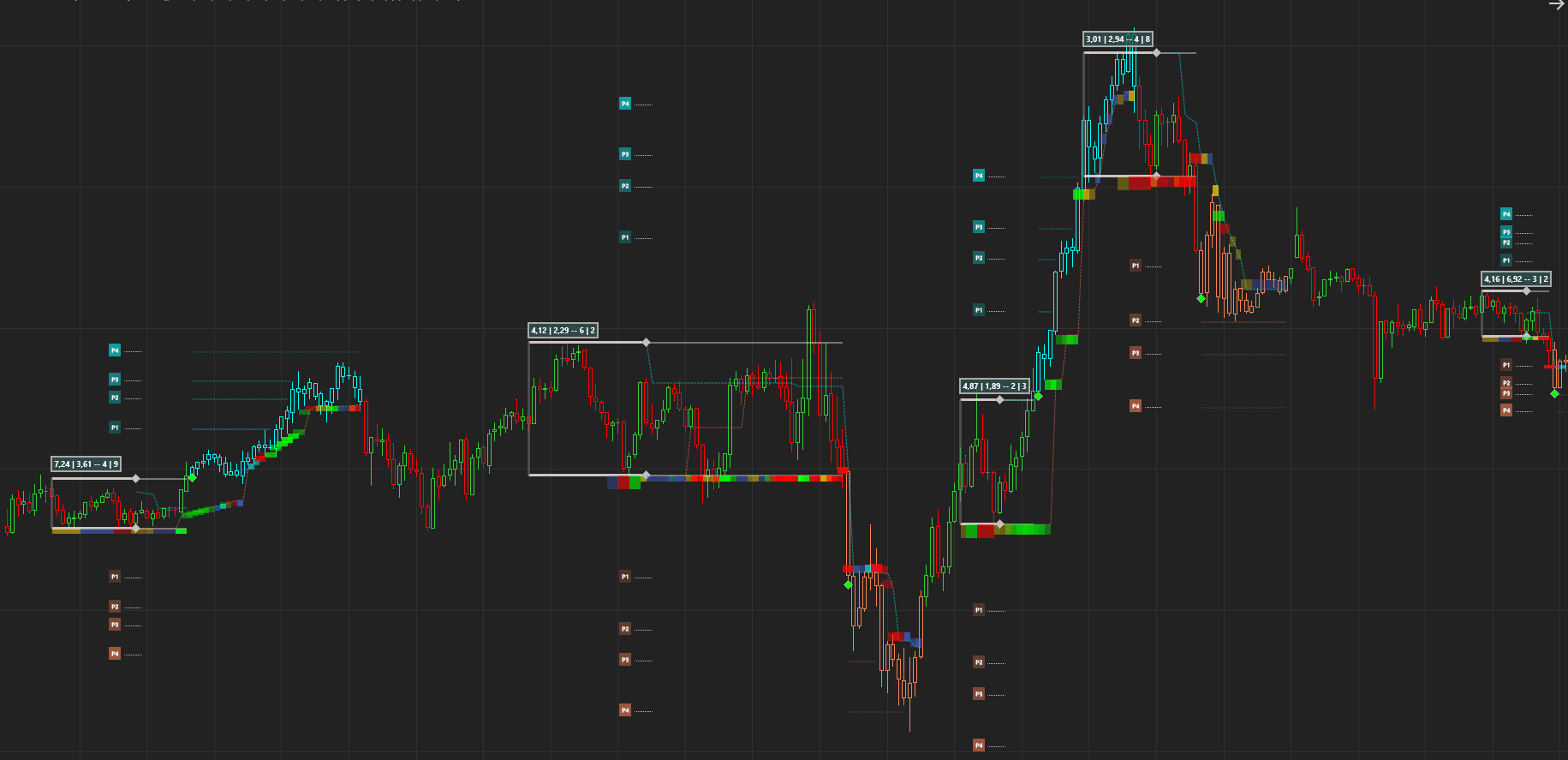

To illustrate the potential of trading breakouts and consolidations, let’s explore a couple of case studies of successful trades.

In the first case study, let’s consider a breakout trade on a stock. The stock had been consolidating within a rectangle pattern for several weeks, with clear support and resistance levels. After a period of consolidation, the price broke out above the resistance level with a significant increase in volume. Traders who entered a long position on the breakout would have enjoyed a substantial price increase as the stock continued its upward momentum.

In the second case study, let’s look at a consolidation trade on a currency pair. The currency pair had been trading within a channel pattern for an extended period, with well-defined support and resistance levels. Traders who bought near the support level and sold near the resistance level would have profited from the price oscillations within the channel. By consistently trading the range, these traders could have generated consistent profits over time.

These case studies highlight the potential profitability of trading breakouts and consolidations when the right strategies and techniques are applied.

Conclusion: Unleash Your Trading Potential with Breakouts and Consolidations

In conclusion, trading breakouts and consolidations can unlock your potential for profit in the financial markets. By understanding and identifying these patterns, you can capitalize on the momentum created by breakouts or profit from the price oscillations within consolidations.

Remember to employ proper risk management techniques, such as using stop-loss orders and practicing disciplined trading. Utilize tools and indicators to aid in identifying breakouts and consolidations, and consider implementing strategies such as the retest and continuation or range trading approaches.

Through practice, observation, and analysis of real-world examples, you can develop the skills needed to become a successful breakout and consolidation trader. So don’t wait any longer – unleash the power of trading breakouts and consolidations and unlock your potential for profit today!

Learn more about our Break-out trader indicator here: https://quaderr.com/break-out-trader/