Our strategy builder has an extensive tool kit that allows you to build many great strategies with ease. From standard indicators to premium Quaderr tools , Market structure analytics as well as price action methods.

Let`s build a simple reversion strategy in a couple of easy steps.

Firstly we need to load a chart with 80 days or so of data. In this example we will be building this strategy with 80 days of 5 Minute MNQ data.

Define the type of system that you want to develop

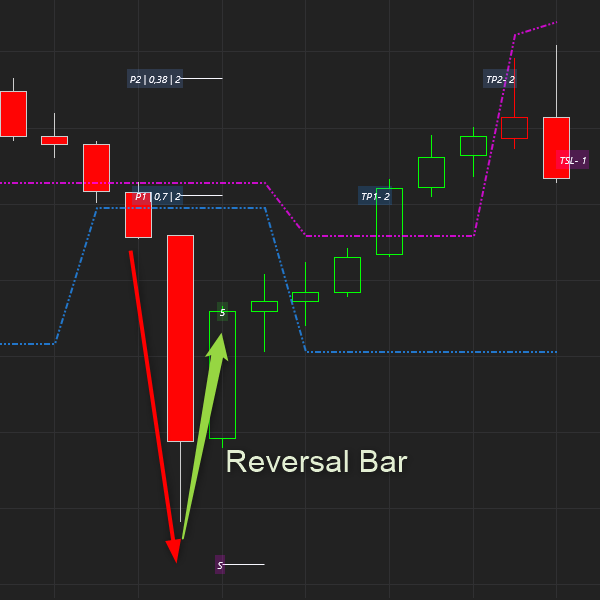

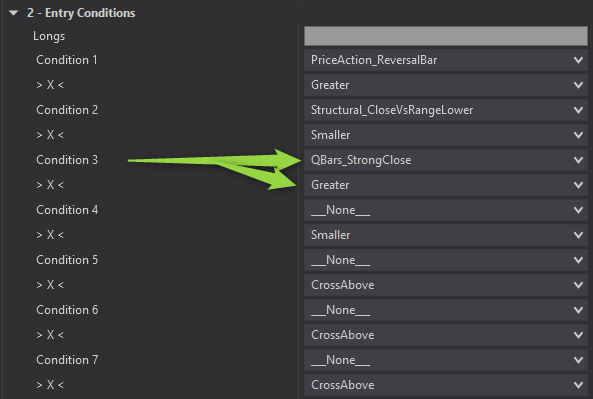

To begin with we need a reversal bar , a Reversal bar is simply when the Close is up from the previous and the previous close is down from the close before that. a Simple V – shape pattern. Secondly , we need the price to revert to some mean or level. Thus the price must be below this level.

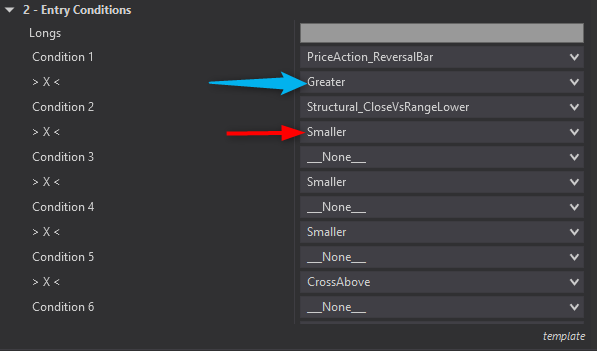

Simply select the Price Action Reversal Bar condition from the drop down menu and set it to Greater as we want it to be an upwards Reversal Bar.

Select the Structural Close versus Range Lower condition and set it to Smaller as we want to trade when the price is below the Lower level of the Range

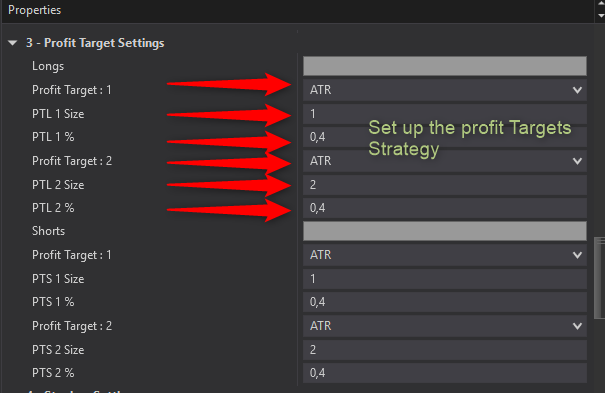

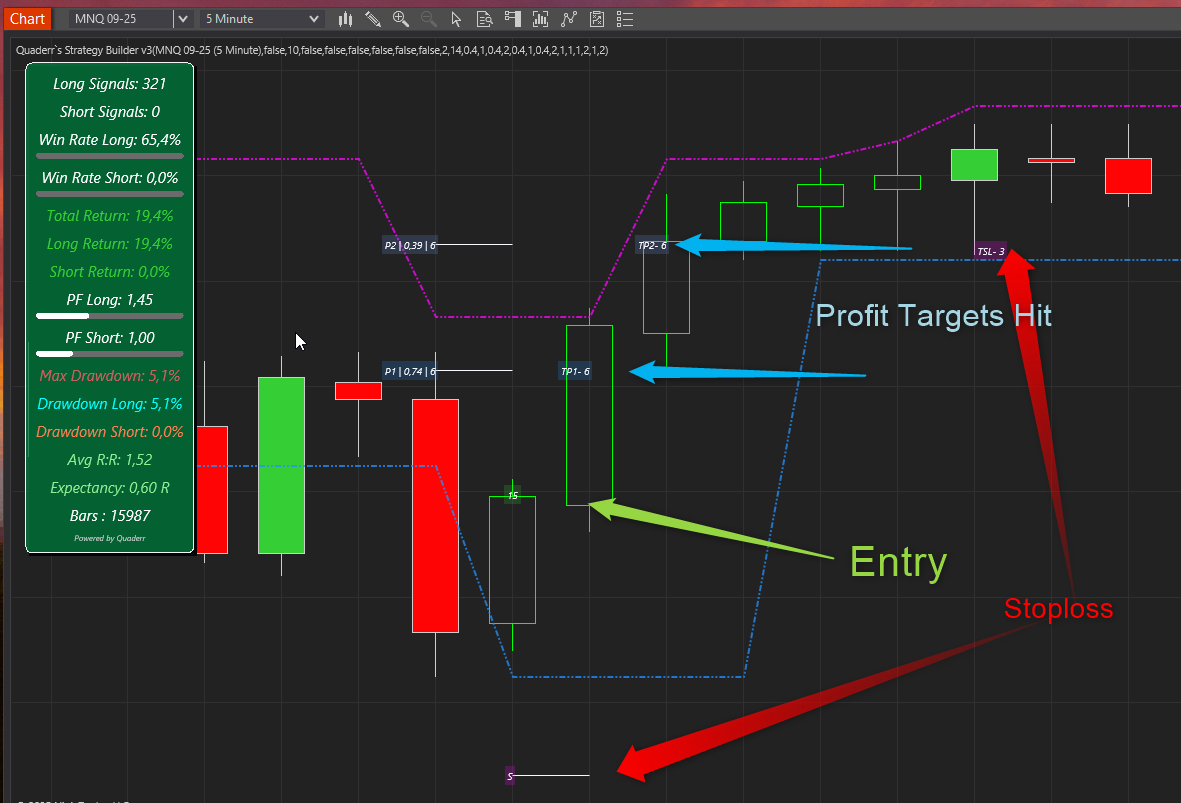

Setting Up Profit Targets

Next we simply define how we would like to exit profit targets. We simply set up 2 separate targets. the first target we set at 1 ATR from our entry price and the second target at 2*ATR from entry. We also set it to exit 40% at each level which will leave us with 20 % to trail with our trailing stoploss. The first target is really close so this one should be reached quite often and will help the strategy have a higher win rate. The second target and trailing stoploss we have set up so that we can ride good trades when they occur, but since they are less probable we leave a small percentage of our position for these events.

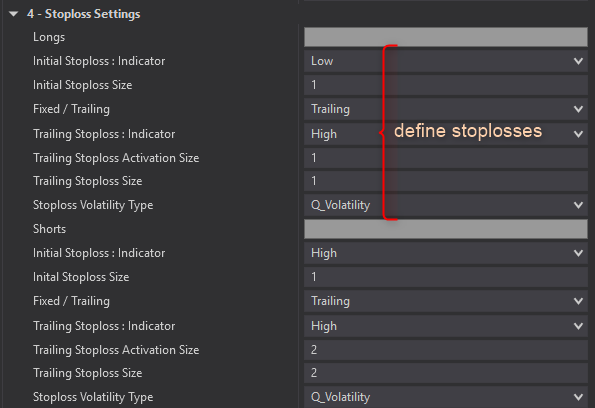

Defining Stoplosses and Trailing Stoplosses

We will work the stoploss in two phases, First we set the initial stoploss to the Low of the bar minus 1 volatility measure.

Then we activate the trialing stoploss with the drop down menu.

We then set the trailing stoploss to only activate once the price has moved 1 volatility measure in our direction, else we wait with our stop at the initial level.

Finally when the trialing stoploss is activated we trail it by 1 volatility measure below the High of the bar. We have many different methods available in the strategy builder for you to choose from, we just found this setup to work well with this type of strategy.

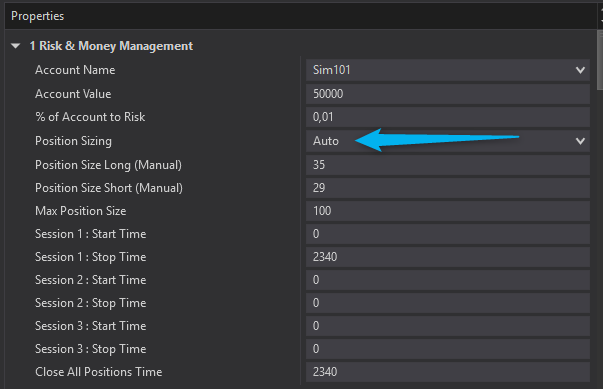

Position Sizing and Risk Management

In terms of position sizing, we set it to “Auto” this will then calculate how many contracts to trade based on our set account value of $ 50000, the distance to the stoploss and a risk percentage of 1 %. This means that we only risk a max of $ 500 per trade. If the stoploss is closer , it will trade more contracts and vice versa.

Results

775 trades, very significant. We need to check our results over many trades

59.2% success rate sounds good for a reversal type strategy as the market mean reverts more than it trends.

The profit factor of 1.13 is very marginal, very random, thus not great. The return is nearly double the drawdown which is promising. Most of the relatively small drawdown probably comes from the position sizing and fast and effective stoplosses.

Improving the strategy

Now we only have 2 conditions specified and a large amount of bad trades that we can filter with more entry conditions (filters)

If we add another condition like we did above ( Q-Bars Strong Close) , which simply means that the Close must be strong, Higher than 80% of the High -Low range, the results improve significantly.

This extra filter almost halved the number of trades but also almost halved the drawdown. The return is roughly the same . Profit Factor of 1.45 a Major improvement!

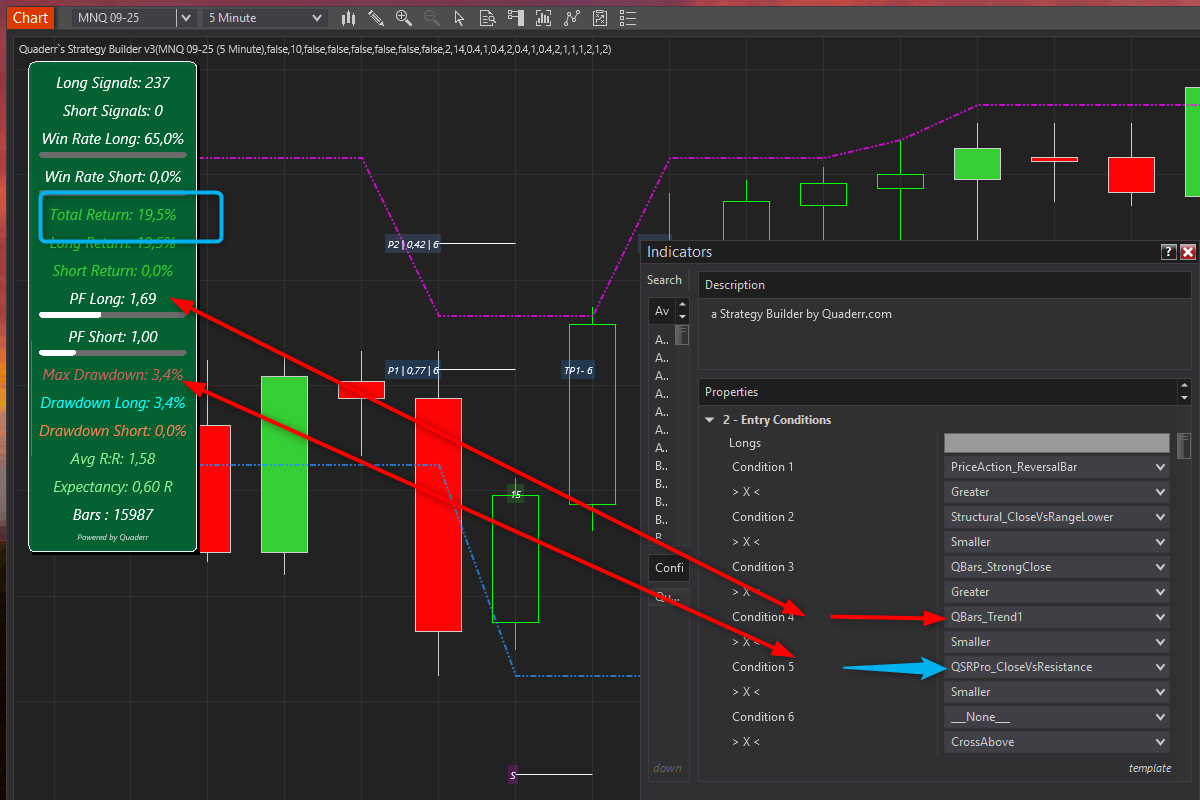

We can continue to test different filters to improve this strategy. Some will improve the strategy and some wont but at least there is a ToolBox in this strategy builder with over 80 possible filters that you can test.

Developing strategies can be very time consuming, this tool makes it really easy , fast and effective to do so.

For more information about this strategy builder, please visit our page here : https//quaderr.com/quaderr-strategy-builder

has been added to your cart!

have been added to your cart!