LASR:

Liquidity Absorption Support and Resistance

LASR in Action

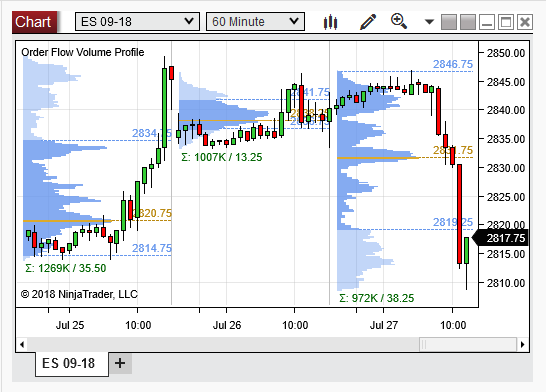

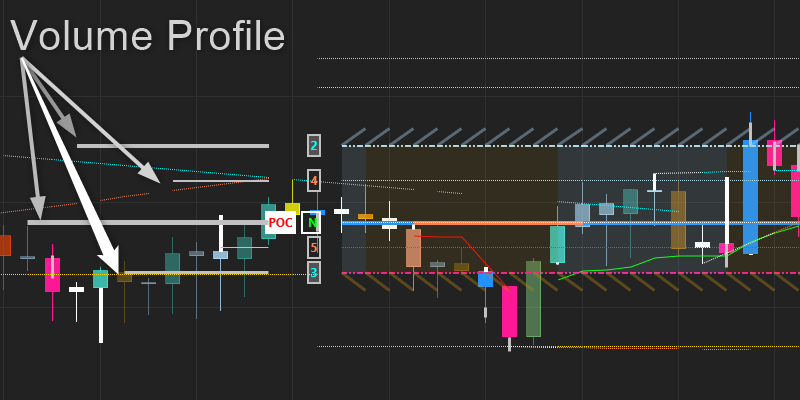

Volume Profile

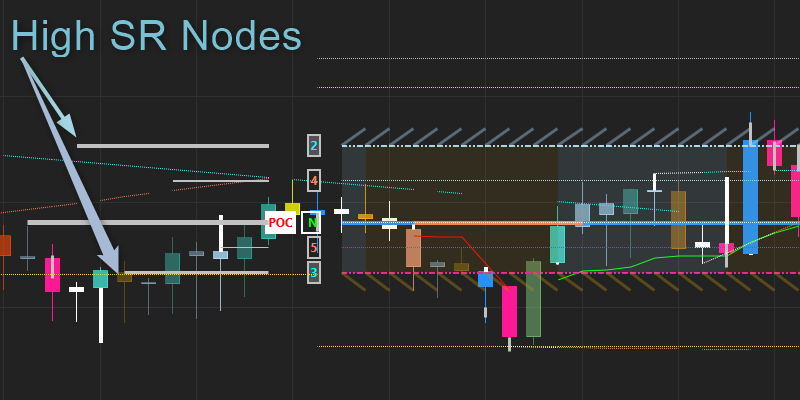

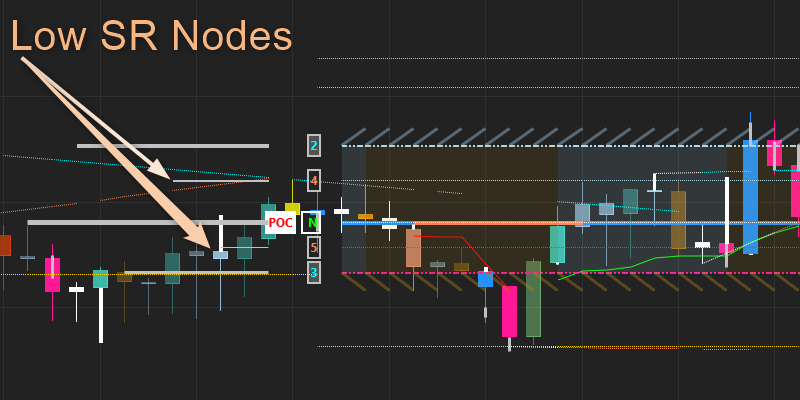

Volume Profile is a trading tool that shows the trading activity at different price levels. It’s like a volume heatmap along the vertical axis of a price chart. By identifying areas where high volumes are traded, you can spot key support and resistance levels. The higher the volume at a price, the stronger the level.

High-volume nodes signify strong support or resistance, where prices often consolidate. Low-volume nodes show areas with little trading, allowing prices to move quickly through them.

LASR Video 2

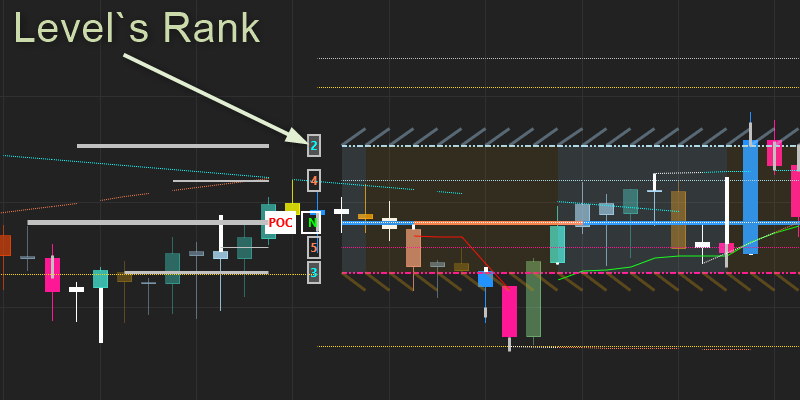

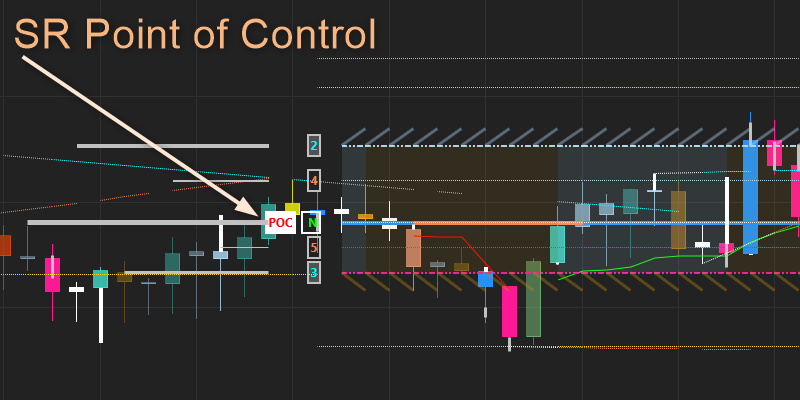

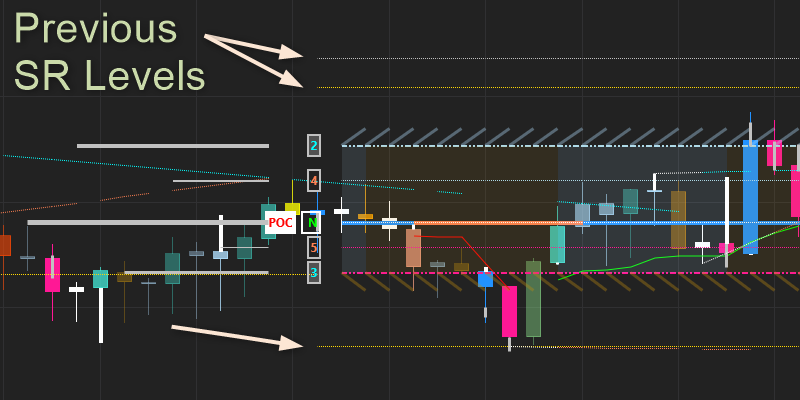

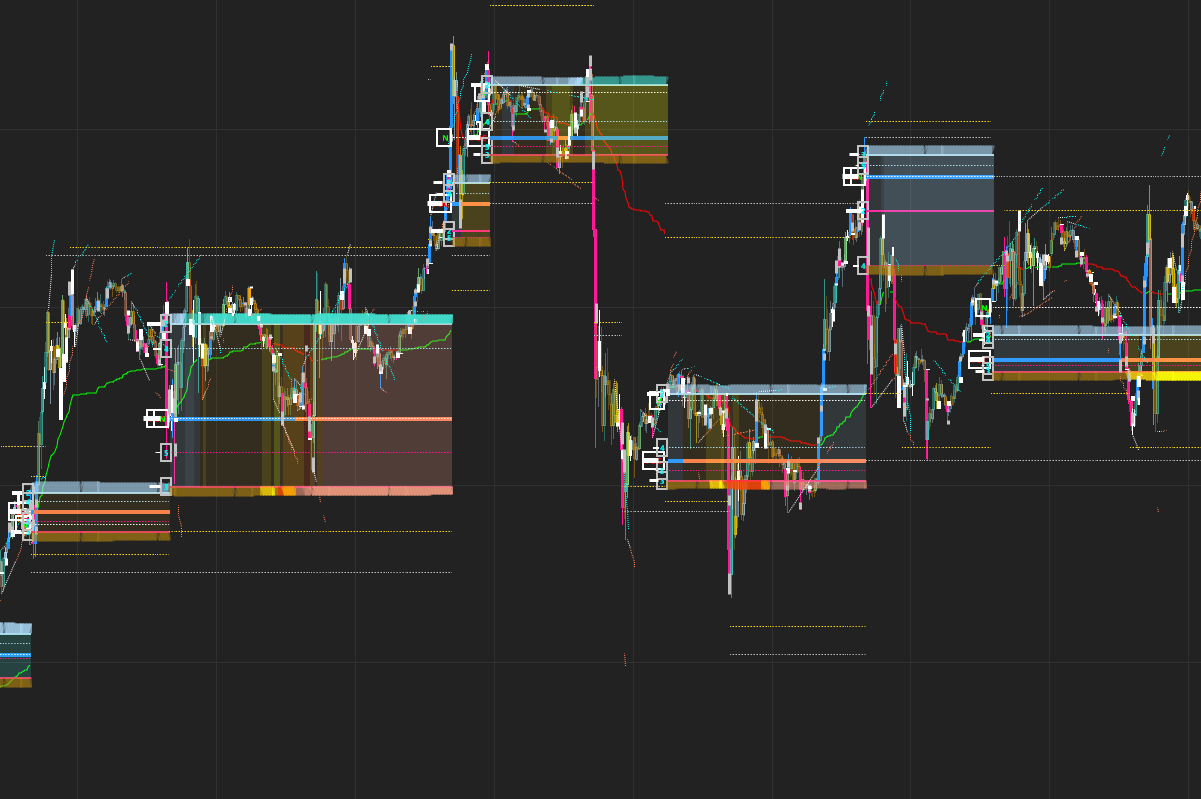

6. Previous SR Levels

LASR finds 2 Support and 2 Resistance levels outside of the newly forecasted Volume Profile. The Yellow lines represent SR levels derived from Low Volume Nodes and the White lines represent SR Levels derived from previous POC levels ( Strongest level in the Volume Profile. These levels are updated if the market breaks them.

More features

Since we have accurately defined and identified a new Volume Profile distribution we can measure some very handy metrics for this new distribution:

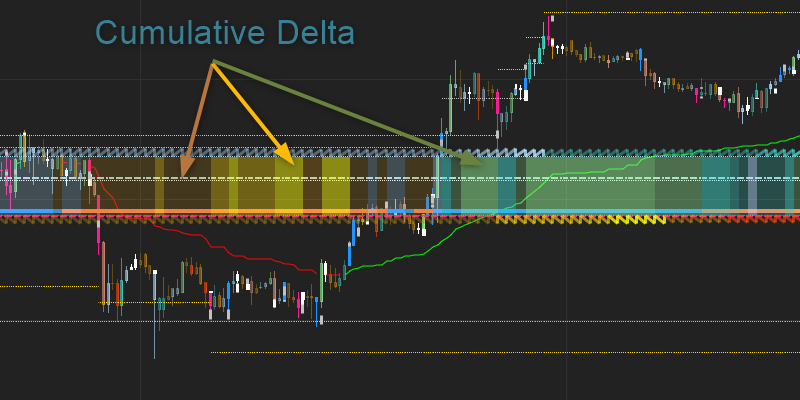

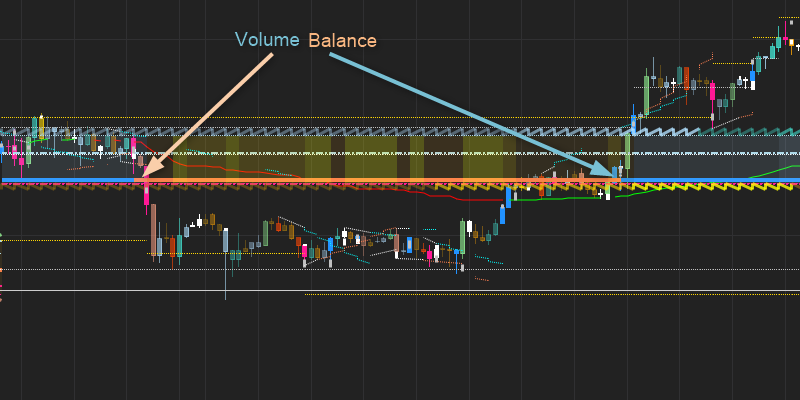

* Cumulative Delta and Liquidity Zones

We call the range of this Volume Profile distribution the Liquidity Zone. This is the area where the market is in a accumulation phase before it breaks out to establish a new Volume Profile and Liquidity Zone.

We color the zone with the values from the Cumulative Delta.

We reset the Cumulative Delta calculation when a new Volume / SR profile spawns.

When the Cumulative Delta is positive the Liquidity Zone color changes from Gray to Blue and to Green depending on how high the value of the Cumulative Delta is compare to it`s average and deviation from the past. The colors for negative values goes from Brown to Yellow and Red.

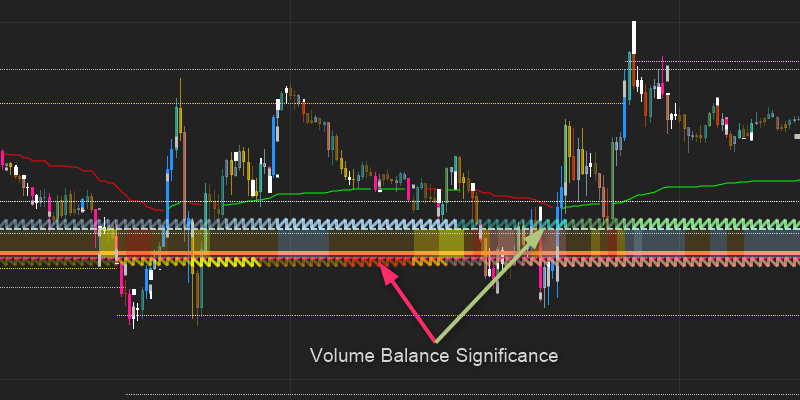

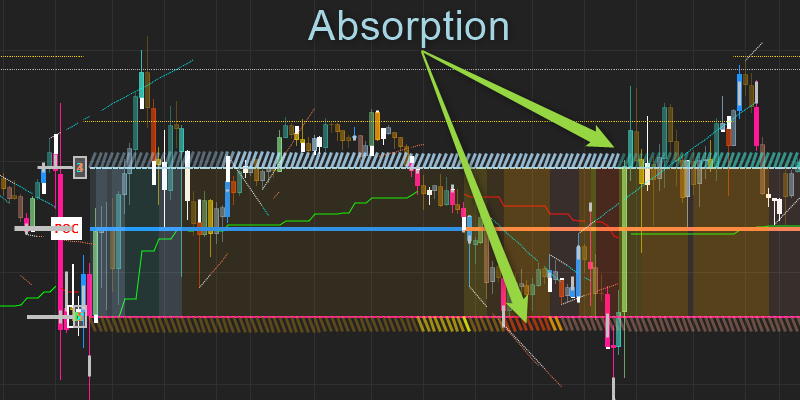

* Volume Balance Significance and Absorption

The Volume balance significance measures how strong the volume imbalance is currently compared to previous values. This is based on the average and deviations of past values. The color changes follows the same scheme as the cumulative delta. The greener or redder the colors the more significant the current values are. This shows us how much absorption there has been in this range.

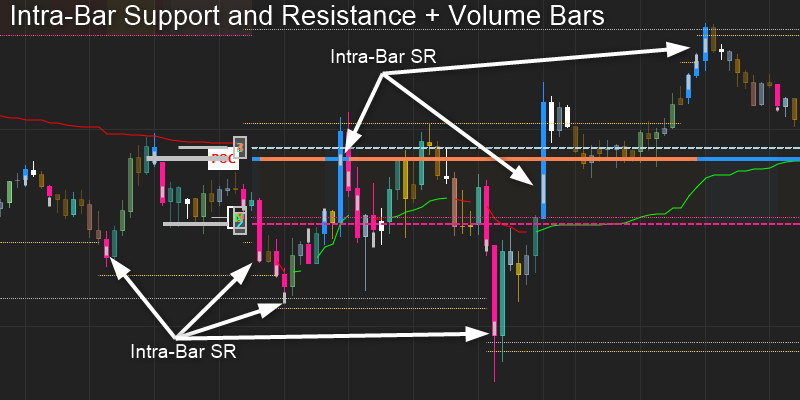

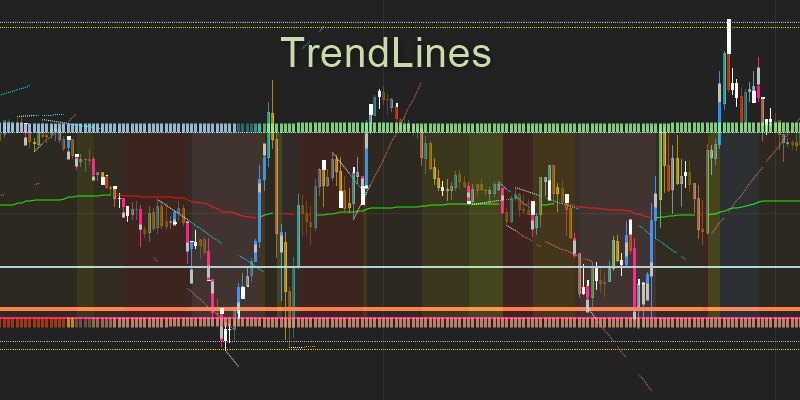

* Intra-bar Support and Resistance + Volume Bars

We use Smart Money High Volume bars as the base input for this indicator so it would make sense to reference these bars and compare them to the levels created going forward.

The bars are colored Blue and Pink with a silver line showing the are of the intra-bar support/resistance level. You can see how the market finds volume around our levels. This shows that the levels are accurate and useful. It also validates the level and help us see when a break of the level is valid. These levels are extremely helpful in fine tuning entry and exit levels intra-bar.

The bar colors of the other bars change color according to the amount of ‘heat” experienced in that bar. You can read more on this here.