Neo Auto: an Unique Automated Trading Strategy for NinjaTrader.

Elevate your trading with our refined Automated trading strategy, combining precision, risk management, and convenience. It’s trading made smarter and more accessible.

Automated Trading Strategy: Major Breakouts, Maximum Potential

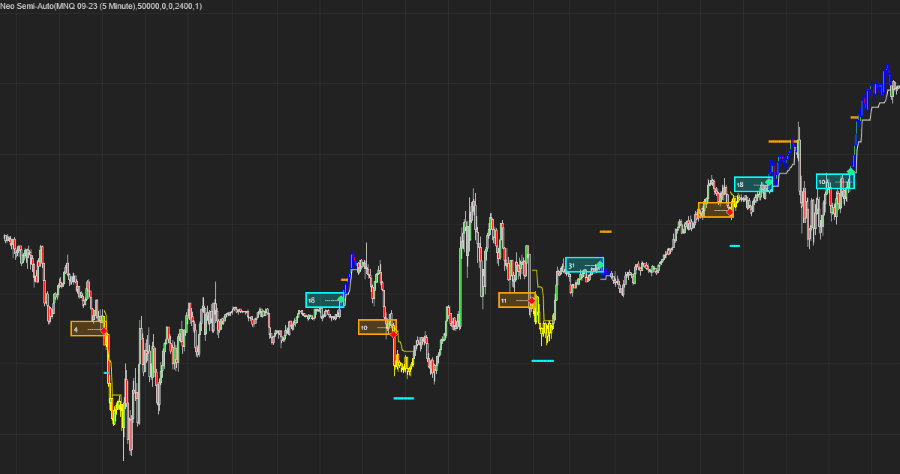

Our automated trading strategy zeroes in on “major” breakouts on the MES and MNQ futures contracts, those pivotal price level breaches fueled by substantial momentum. We understand that not all breakouts lead to success, but we’ve uncovered an exploitable edge.

Our approach is designed to capture significant moves, exiting 50% of the position at a predefined profit target while riding the remainder for maximum gain.

Our Automated Trading Strategy: Mastery of Risk Management

Initially designed for long trades, we recognized the importance of versatility.

Our automated trading strategy now encompasses short trades, which, while performing slightly differently, contribute to a more well-rounded system. Our core objective has always been to fine-tune position sizing and risk management, ensuring that every trade adheres to a fixed risk percentage—approximately 1%.

Our Clients’ Needs

This aligns seamlessly with the needs of our clients, especially those pursuing evaluation accounts. These accounts require a $3,000 profit while permitting a $2,500 drawdown on a $50,000 account. With our 1% risk per trade ($500), you can endure up to 5 consecutive losses without jeopardizing your evaluation. Success hinges on achieving a net gain of six profits over losses, a realistic target.

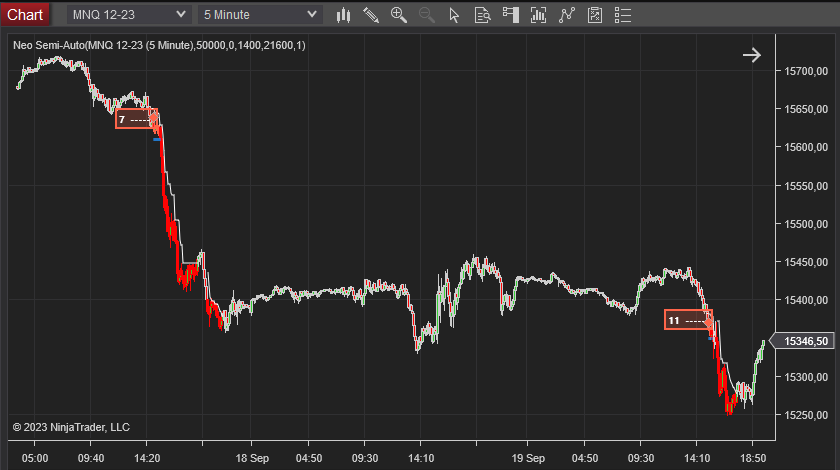

Enhancements in Stop Loss and Profit Targets

We’ve revamped the trailing stop loss, making it faster and more effective. Additionally, we’ve fine-tuned our profit targets for improved precision.

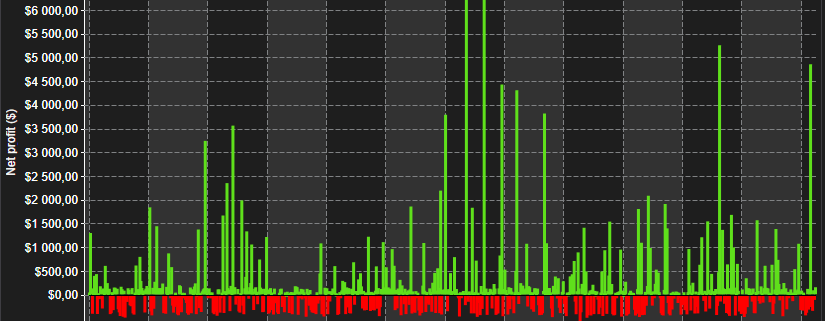

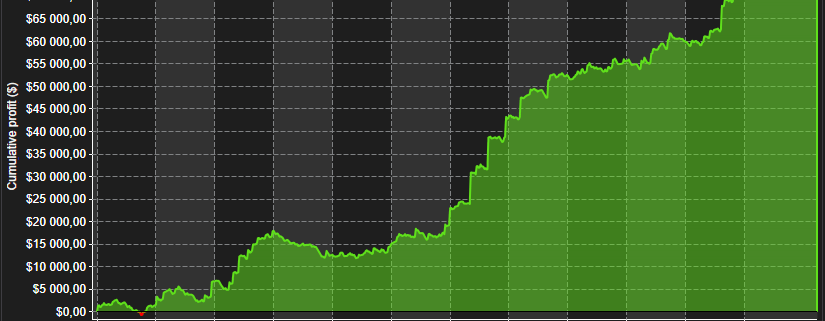

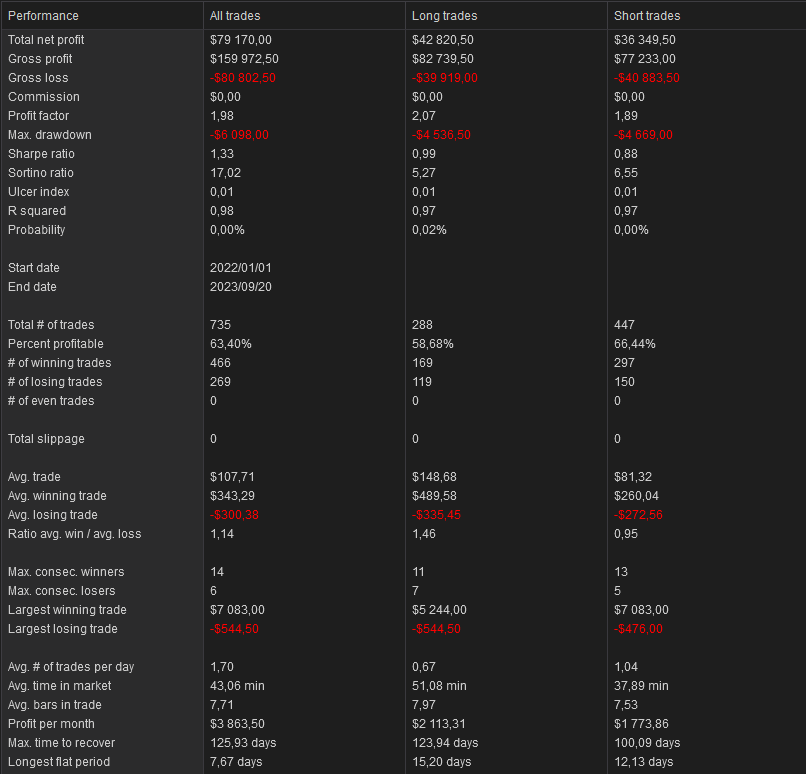

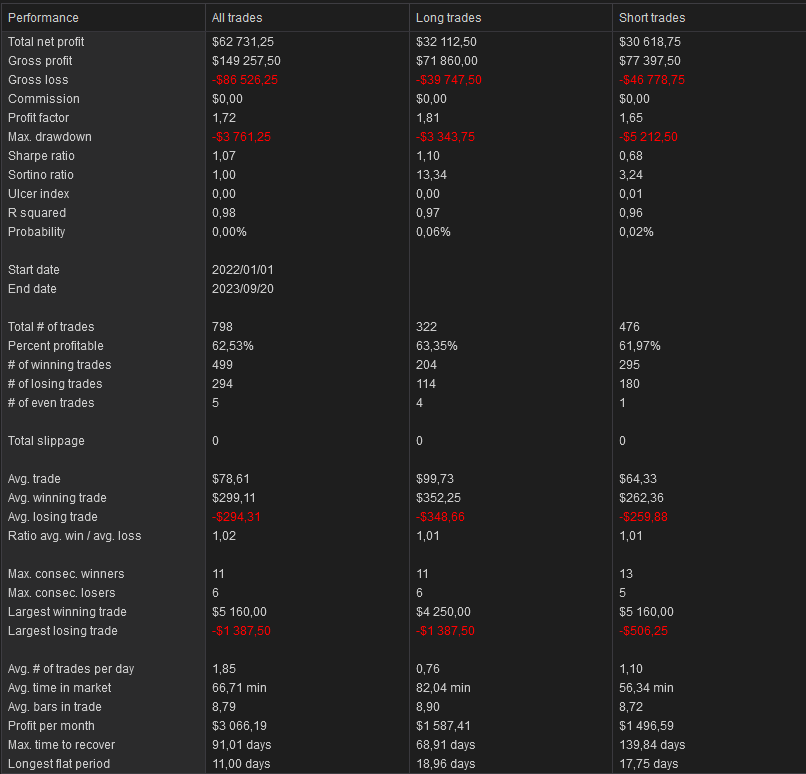

Automated Trading Strategy: Hypothetical Results – MNQ

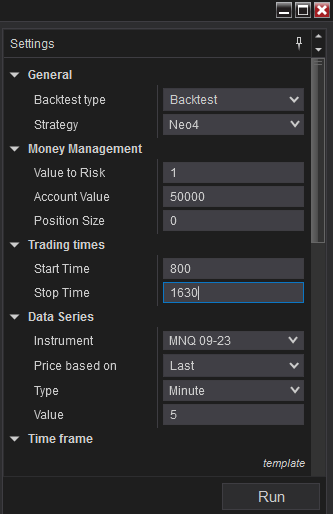

The hypothetical results displayed below are based on an 18-month period commencing in January 2022.

These results are derived from a $50,000 account, risking 1% of capital per trade, with profits not reinvested.

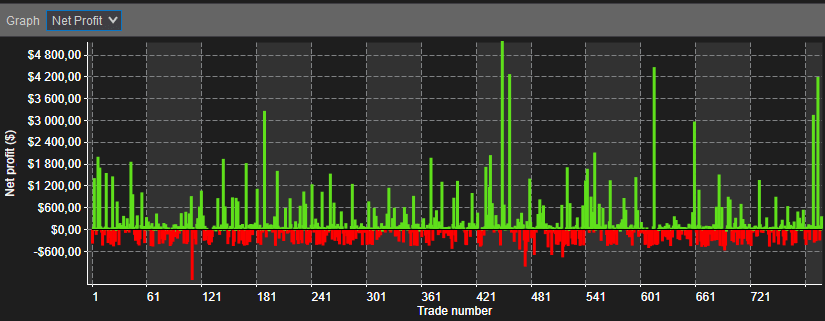

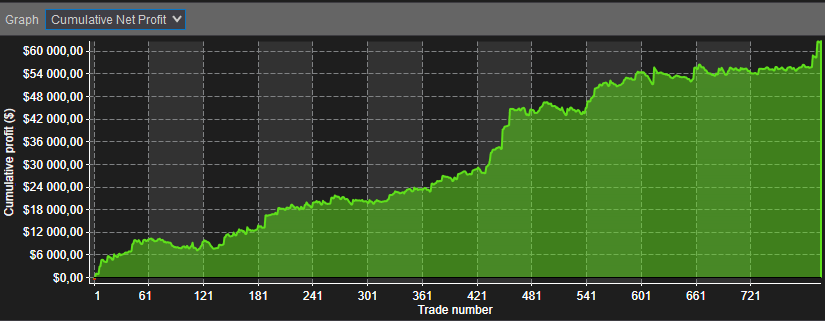

Automated Trading Strategy: Hypothetical Results – MES

The hypothetical results displayed below are based on an 18-month period commencing in January 2022. These results are derived from a $50,000 account, risking 1% of capital per trade, with profits not reinvested.

Fine-Tuning Risk Percentage

While we set the risk percentage at 1% in this test, adjusting it to 0.5% to 0.8% would keep us within the maximum drawdown requirement. However, it might extend the time needed to reach the profit target.

With these simple steps, you’ll be up and running, ready to make the most of this tool’s trading potential.