Q-Dots is designed to take advantage of High Frequency Scalping Opportunities.

Explore Q-Dots now

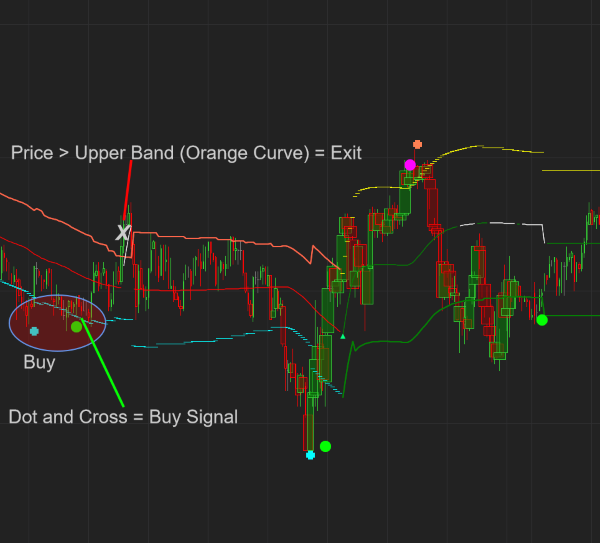

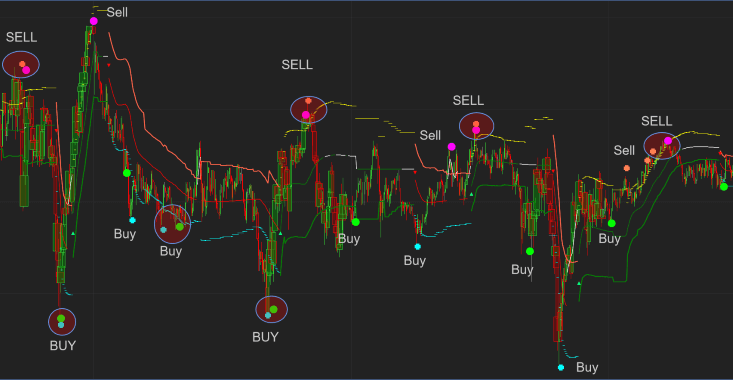

This Ninjatrader Indicator is best suited to non-trending/ range-bound markets. When the market gets overbought or over sold it accurately finds the level where the market should revert back to a mean.

When the market is above or below its range, it’s best to trade this Indicator only in the direction of the big trend. In other words when its above its range only enter long and when it’s below its range only enter short when the signals are plotted (dots).

How to Trade Q-Dots?

A Typical Trade Set-up using Q-Dots:

We hope that you will find this Indicator as useful as we do. The signals are faster and more accurate than anything we’ve seen or used before.