This Ninjatrader Indicator is based on Volume Profile. It’s an amazing tool for finding break-outs and support and resistance.

Learn how Q-VPSR works

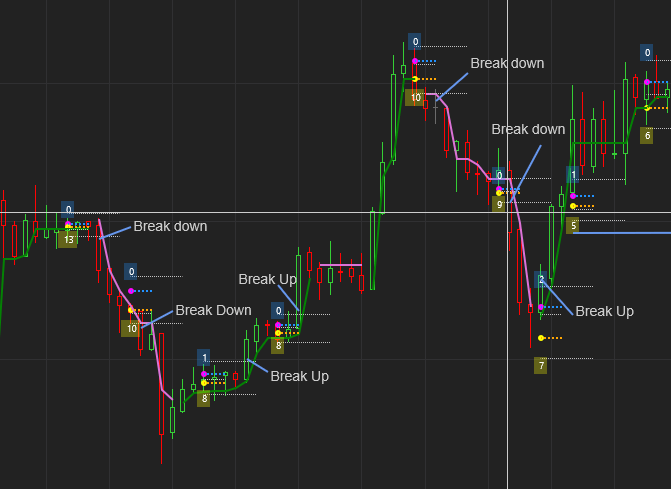

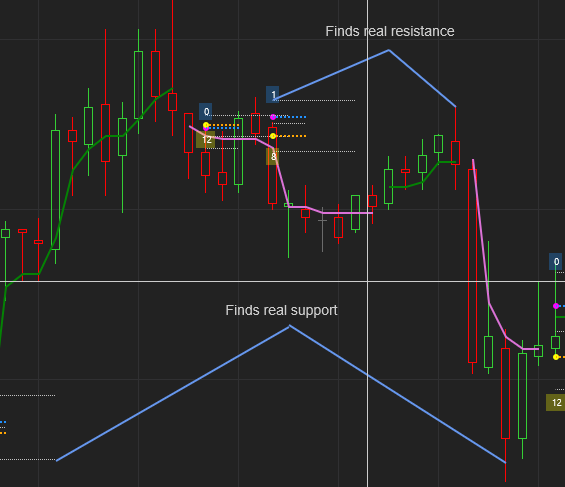

Volume Profile is a very effective means of finding support and resistance. These SR levels often repeat in to the future. The market has some memory.

These levels are not necessarily swing highs or lows. They are levels where the market found significant Volume, supply and demand were balanced and then moved beyond this “equilibrium” point. These levels act like magnets, drawing the market towards it and pushing the market away from it. (Reversion / Momentum)

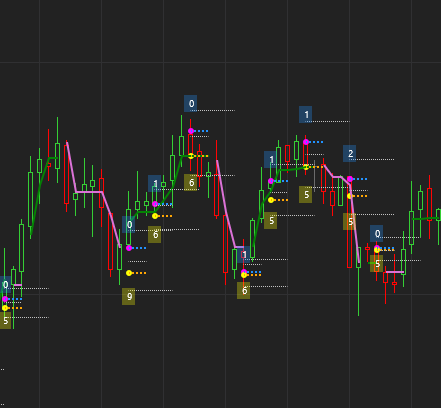

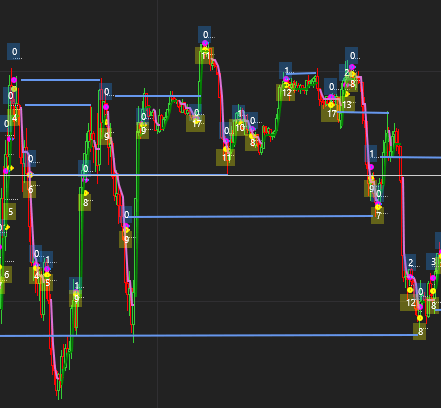

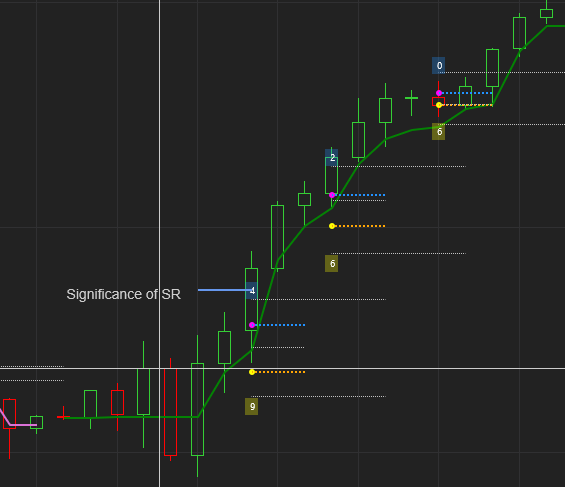

Q-VPSR in Action

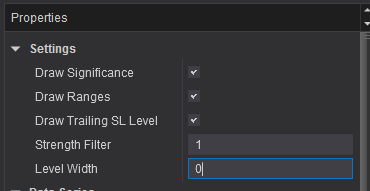

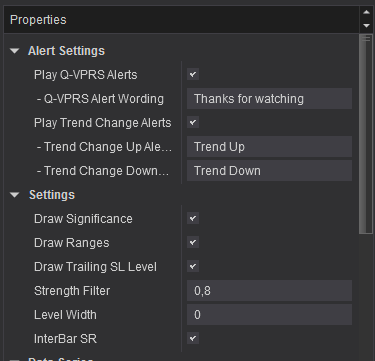

Settings:

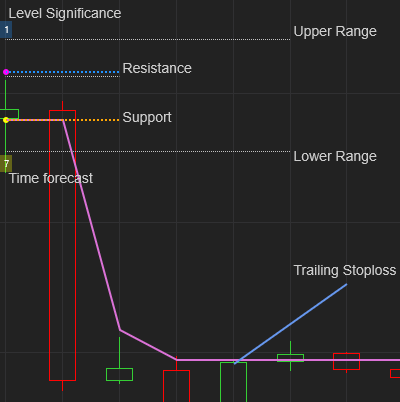

* Draw Significance: This will draw the Level Significance number of times a level was hit when ticked.

* Level Significance: This number (“1” in a Blue border) tells us how many times this level has been a Significant Level in the past.

* Draw Ranges: This will draw the upper and lower ranges Levels if ticked. See:

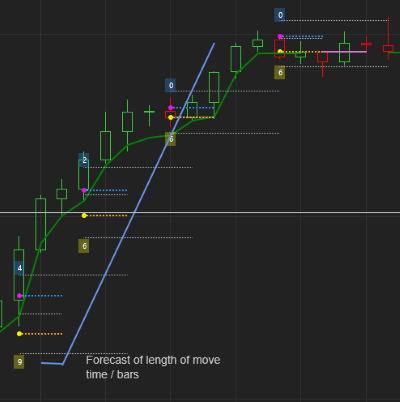

Upper Range: a Break Above this level signals a potential Break – Out to the Upside.

Lower Range: a Break Below this level signals a potential Break – Out to the Downside.

* Draw Trailing SL Level: If ticked, this will draw the Trailing Stoploss / Trend Indicator curve.

* Strength Filter: This Setting determines how Significant a Volume Profile Level must be in terms of Volume. 1 is average, “0” is not significant and 2 would be very significant. The lower this setting, the more signals you will get and vice versa. More signals may be less significant.

* Level Width: When this is set to “0”, The indicator will plot/extend the SR and Ranges lines by the period of the the Time Forecast, ie” X Bars. If you set this to any number but “0” the indicator will extend/ plot the lines to the number of bars that you have set.

-

This is good indicator Jaco. I been playing SIM, very good signals.