RM Trader in Action

Trade Design Ideas – RM Trader

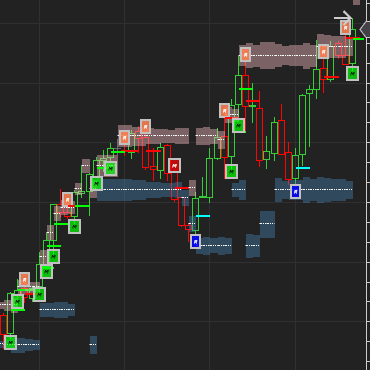

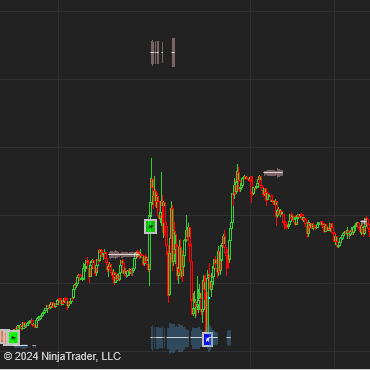

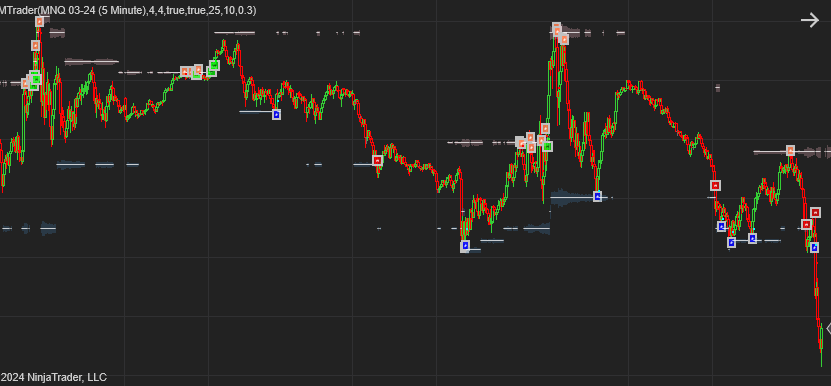

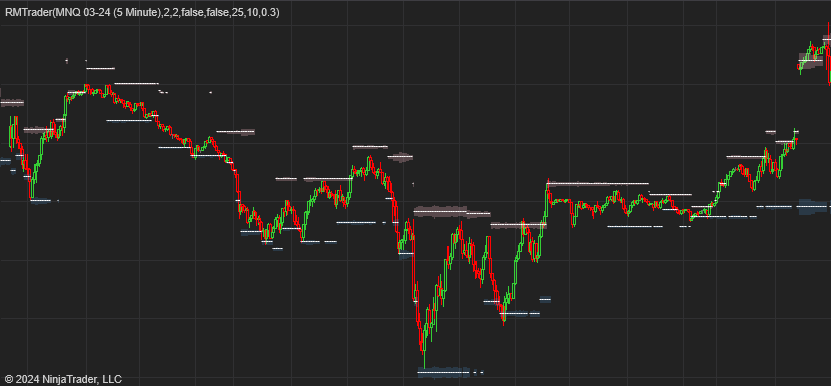

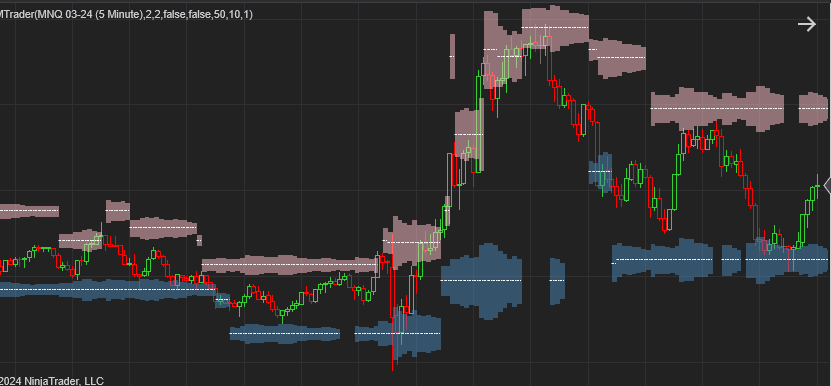

The idea behind trading with the RM Trader is that the market flows in to areas of support / resistance ( accumulation) and then breaks or leaves these levels ( distribution) to move on to previously created levels or new levels that are developed when the accumulation starts again. The market brakes again from this level and so on and so on. Below is just a general idea of how you could use this indicator. We are sure that you will develop some great ideas of your own.

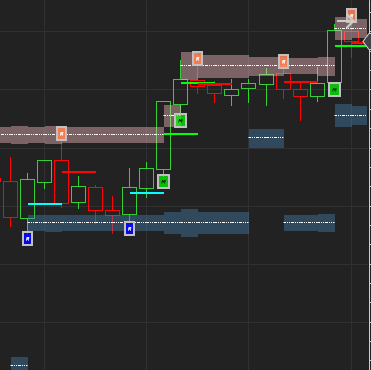

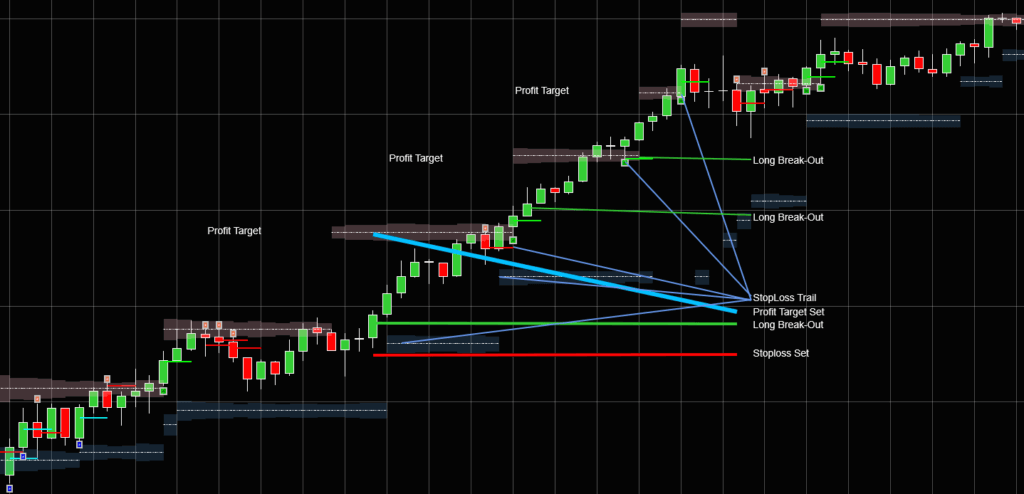

RM Trader – Momentum Trades / Break-outs :

(Long) When the market convincingly breaks above a level we enter long,

This broken level now becomes support and thus we have to set our stoploss a little below this level.

When the market breaks above or forms a new support level below the market, you can trial your stoploss upwards.

The next level above this broken level is our profit target. If a new level is formed above our entry level then this becomes our profit target.

The best brake-outs generally occur when the market has consolidated around a level for a while, building up steam to break out of this level and range. Very large, sharp up trended moves in to this level with little pullbacks on the way produce less good results.

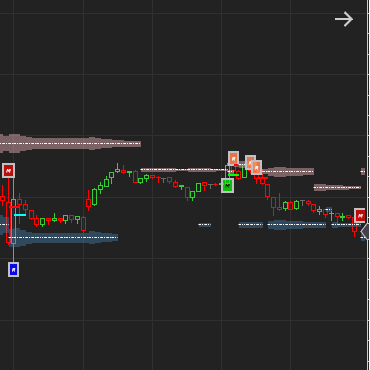

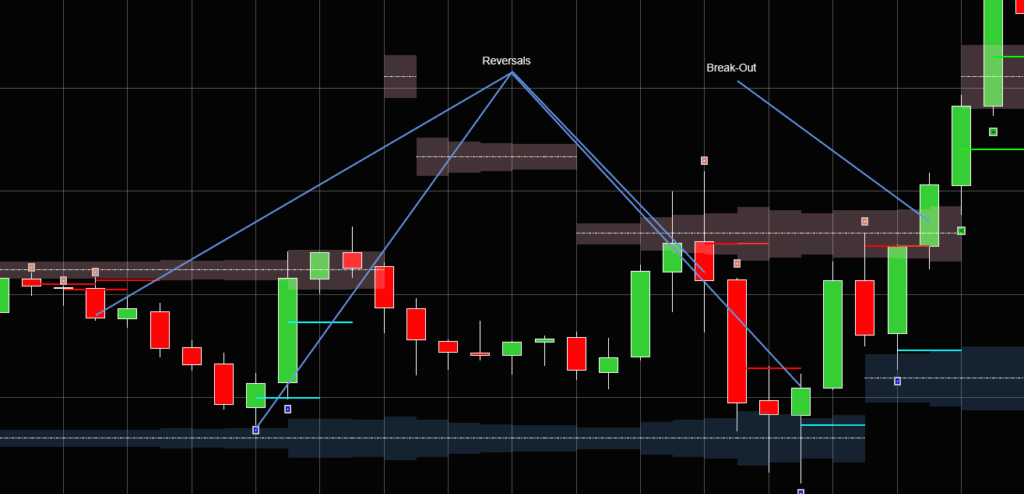

RM Trader – Reversal Set-Up:

(Short) When the market trades up in to our level and it fails to convincingly break through above the level. This makes for a good reversal trade set-up. When the market pulls back we enter our short. Two or more highs above this level with the closes below this level shows that the market is testing the level but not breaking it.

Once a trade is entered , This tested level becomes our stoploss level, so set it slightly above this level.

The support level below this level is the profit target level.

The best reversal trades occur generally when the move upwards was fast, large and with few pullbacks on the way or a consolidation around this level with out breaking it and then moving down convincingly

Some ideas to ponder.

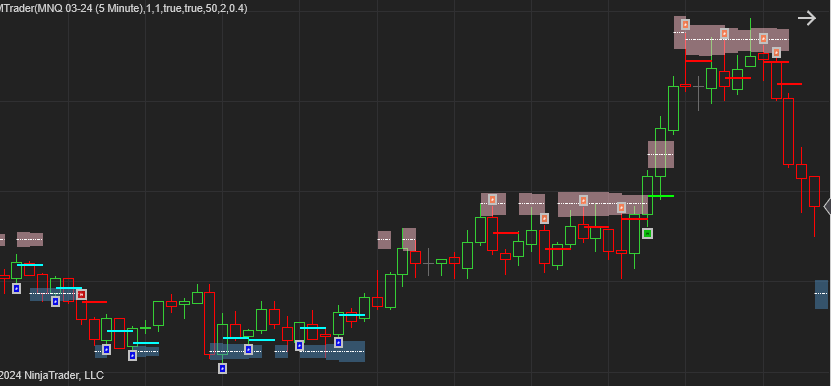

The indicator`s purpose is to show how the levels develop, changes and adapts. The signals giving are just a notification to show you when levels are broken or rejected. They are not intended to provide absolute signals although they work very well at that . Please study the markets and find what works best for you. Combining more indicators with RM Trader will vastly improve on it. Always considering the market context will also go a long way in improving your trading system.

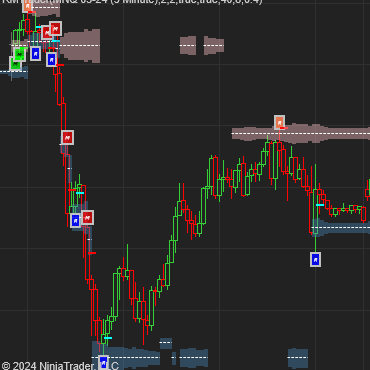

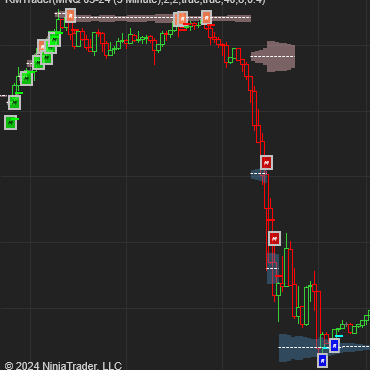

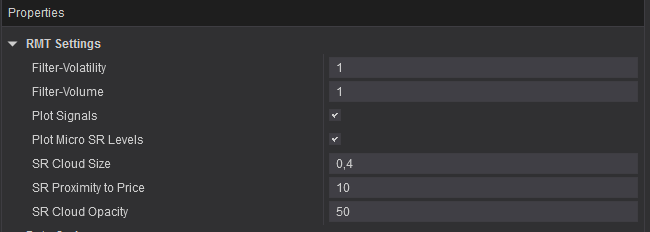

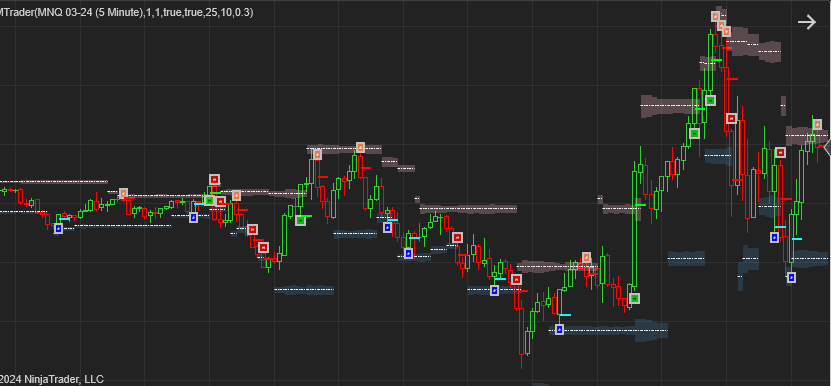

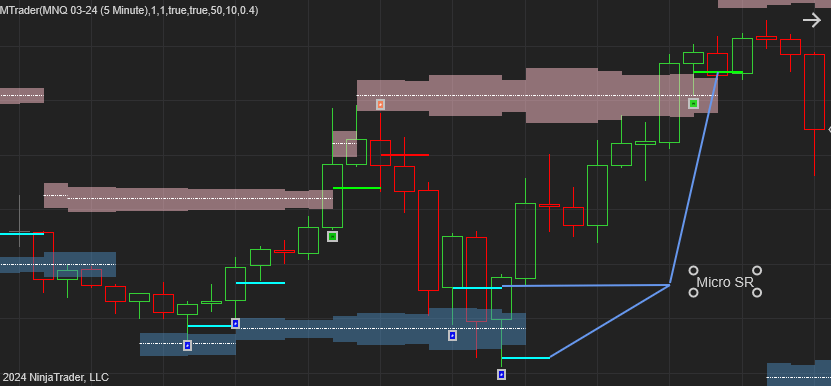

RM Trader – Fast Setting:

Ideal for scalping and faster strategies, these settings (e.g., Volume = 1, Volatility = 1) provide more levels for quick decision-making. When the setting are low, say around 1 for Volume and Volatility, the indicator filters less strictly and provide more levels. These settings are preferred for scalping and faster strategies.